Monday 14 March 2011

by: Pat Garofolo | ThinkProgress | Report

As we’ve been documenting, several conservative governors have proposed placing the brunt of deficit reduction onto the backs of their state’s public employees, students, and middle-class taxpayers, while simultaneously trying to enact corporate tax cuts and giveaways. Govs. Rick Scott (R-FL), Tom Corbett (R-PA), and Jan Brewer (R-AZ) have all gone down this road.

Following suit, Gov. Rick Snyder (R-MI) has proposed ending his state’s Earned Income Tax Credit, cutting a $600 per child tax credit, and reducing credits for seniors, while also cutting funding for school districts by eight to ten percent. At the same time, as the Michigan League for Human Services found, the state’s business taxes would be reduced by nearly $2 billion, or 86 percent, under Snyder’s plan:

Business taxes would be cut by 86 percent from an estimated $2.1 billion in FY 2011 to $292.7 million in FY 2013, the first full year of the proposed tax changes…Taxes on individuals from the state income tax would rise by $1.7 billion or nearly 31 percent, from an estimated $5.75 billion in FY 2011 to $7.5 billion in FY 2013, the first full year of the tax changes.

The forces against independent journalism are growing. Help Truthout keep up the fight against ignorance and regression! Support us here.

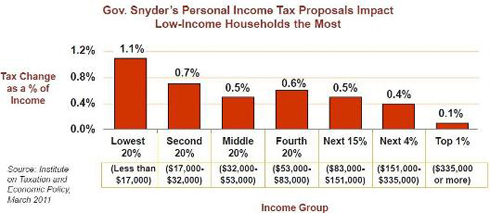

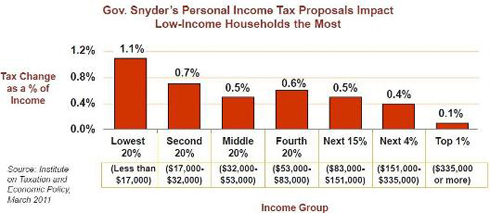

As the Institute on Taxation and Economic Policy found, the practical upshot of Snyder’s tax increases is to place even more of a burden on Michigan’s poorest residents, who will see a bigger hike than those at the upper end of the income scale:

Michigan already has a regressive tax system, which Snyder’s proposal will only make worse. Currently, someone in the poorest 20 percent of Michigan taxpayers pays a tax rate of 8.9 percent, while someone in the richest one percent pays 5.3 percent.

In addition to trying to make an unfair tax system even more problematic for Michigan’s low-income residents, Snyder has also asked that the state be given the power to dismiss local government and appoint emergency “town managers” who could break contracts and “strip powers from elected officials.”

All republished content that appears on Truthout has been obtained by permission or license.

No comments:

Post a Comment